How Tax Preparation can Save You Time, Stress, and Money.

Table of ContentsOur Tax Preparation PDFsFascination About Tax PreparationOur Tax Preparation PDFsTax Preparation - TruthsThe 45-Second Trick For Tax Preparation

Make sure that you understand the form and also see to it that it seems to be exact. If you desire the preparer to be able to speak with the IRS concerning exactly how your return was prepared, check the "Third Event Permission" box on the income tax return kind. Sign the tax return kind.Resources For advice from the united state Department of Treasury Irs about picking a paid tax obligation preparer, refer to:.

In our proceeding effort to place our customers in control of their economic future, Social Safety provides numerous online tools and also resources that conserve time and initiative. This site gives information to tax obligation preparers about different Social Security online services consisting of the my Social Safety and security account that you can show to your clients to assist enhance tax preparation.

No one pays federal income tax on greater than 85 percent of his or her Social Safety and security advantages based upon Internal Profits Solution (IRS) policies. For even more details on when federal earnings tax obligation might put on Social Safety advantages, visit our benefits coordinator web page on Revenue Taxes And Your Social Safety Conveniences.

The 5-Second Trick For Tax Preparation

Regarding the Social Safety Statement. Your Customers Can Get a W-4V Online If you are working with a client who receives Social Safety and security advantages, remember that they have the alternative of government revenue tax obligation being withheld from their advantages at the price of 7, 10, 12, or 22 percent.

You must sign up as well as produce your own password to gain access to Company Solutions Online. One of our concerns is obtaining our customers protect accessibility to the info they need when, where, and how they require it. Our on the internet services have never been far better or easier to use. Social Security is right here to aid you and also your customers protect today and tomorrow.

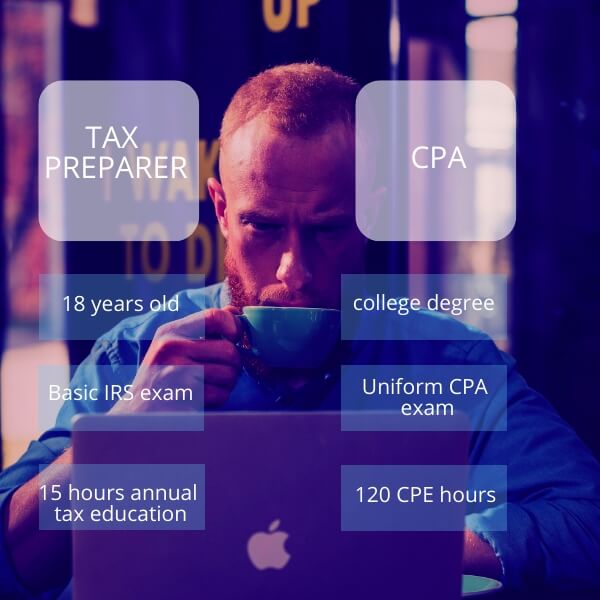

Normal tax preparer rip-offs may entail one or even more of the following kinds of conduct: Burglary of refund Change of tax obligation return files Submitting a return without taxpayer permission Falsifying revenue to generate a bigger reimbursement Falsifying exceptions or dependent information to produce a larger reimbursement Falsifying costs, deductions, or credit ratings to create a larger reimbursement Making use of an inaccurate declaring condition to create a larger reimbursement At your first meeting with the tax preparer and also before the tax obligation preparer renders solutions for you, ask the tax preparer to provide you a created declaration that declares: the private tax obligation preparer's name, address, as well as webpage phone number; that the individual tax obligation preparer is not a licensed public accountant, an enrolled agent, or a tax obligation attorney; services that the specific tax preparer is certified to supply; and the private tax obligation preparer's education and learning and training, consisting of exams taken and successfully passed.

5 Easy Facts About Tax Preparation Described

Wisconsin joins the federal/state electronic filing program, a internet cooperative effort in between the Internal Income Service (IRS) as well as the state earnings agencies. Authorized tax professionals electronically transmit government and state tax return to the internal revenue service. After that the internal revenue service digitally sends out the state return to the Wisconsin Division of Income (DOR) for processing.

ERO and also taxpayer verify straight down payment details if you have a reimbursement - Tax Preparation. ERO and taxpayer confirm direct debit info if you have an amount owed. ERO and taxpayer review and also verify the information on the returns. ERO provides taxpayer with a duplicate of the tax obligation returns. ERO transfers the returns.

We highly urge digital payment, as handling of paper repayments may take a number of weeks sometimes. November 8, 2021.

Learn more about the key needs, duties, duties, as well as skills that need to remain in a tax obligation preparer task summary.

Facts About Tax Preparation Uncovered

TAX OBLIGATION PREP WORK FOR LOW-INCOME FAMILIES Most people fill out their tax obligation returns with assistance from paid preparers. In 2010, 56. 8 percent of all returns were completed this means. That proportion is somewhat reduced for lower-income families: 54. 5 percent for returns with adjusted gross revenues listed below $30,000 (table 1).

DO PAID PREPARERS LOAD OUT MORE ACCURATE RETURNS? Except in a handful of states, paid preparers are not controlled. The Federal government Accountability Office discovered that returns finished by preparers were not much more precise than self-prepared returns as well as consisted of mistakes in calculating a tax filer's made earnings tax obligation page credit (EITC)a problem particular to low- as well as moderate-income households.

On 13 income tax return in the example, preparers overstated the complete refund by $100 or more (Mc, Tigue 2014). A larger-scale study of Irs (IRS) data revealed that paid preparers had actually a greater approximated mistake rate60 percentthan returns prepared by taxpayers themselves. Several of these mistakes are made by the preparer; some are the outcome of the taxpayer supplying wrong or insufficient info (Mc, Tigue 2014).

Indicators on Tax Preparation You Need To Know

RACs are momentary checking account opened by paid preparers, where tax obligation filers direct their reimbursements. Tax obligation filers are allowed to pay charges out of their RACs. When the IRS transfers the reimbursement, the paid preparer subtracts charges from the account, and after that the tax obligation filer can access the remainder. In 2014, the National Consumer Regulation Center reported that even more than 21 million consumers acquired RACs.